Beyond the Headlines: Stocks Continued to Climb in July

The stock market kept rising in July, thanks to strong company earnings and growing optimism around global trade. The S&P 500 gained 2.24 percent, the Dow Jones Industrial Average was up 0.16 percent, and the Nasdaq Composite led the way with a 3.72 percent increase. These solid results pushed both the S&P 500 and Nasdaq to new all-time highs.

With trade tensions easing during the month, investors shifted their attention to company performance. We’re currently in the middle of second-quarter earnings season, and so far, companies are doing better than expected. On average, companies in the S&P 500 have reported earnings growth of 6.2 percent. That’s more than double the original forecast of just 2.8 percent.

Even more encouraging, 9 out of the 11 major sectors in the market have reported earnings that beat expectations. This suggests that the growth isn’t just coming from a few standout companies—it’s more widespread. Since company performance is a key driver of long-term market returns, this broad-based earnings growth is a good sign for investors.

Technical factors were also supportive for the U.S. market in July. All three major indices spent the month above their respective 200-day moving averages.

While U.S. stocks had a good month, international markets were more of a mixed bag. Stocks in developed countries (such as those in Europe and Japan) fell slightly. However, stocks in emerging markets (such as Brazil and India) rose for the third month in a row. The MSCI EAFE Index lost 1.4 percent in July, while the MSCI Emerging Market Index was up 2.02 percent.

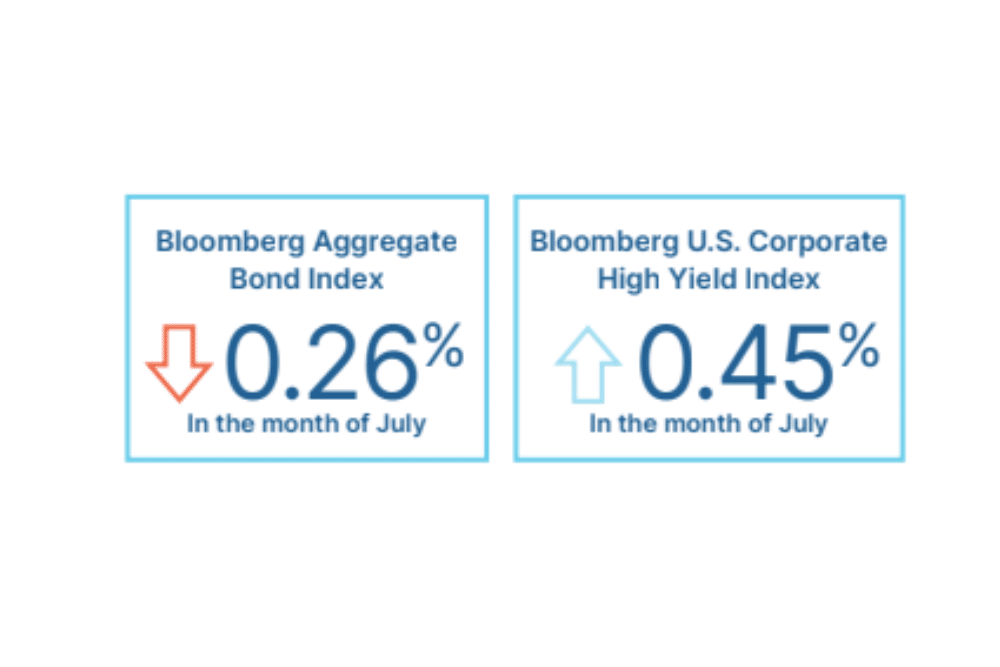

Bond Market: A Mixed Picture Trade Progress Helped Support Markets

Returns in the bond market were also mixed. Long-term interest rates went up, which tends to push bond prices down. As a result, the Bloomberg Aggregate Bond Index lost 0.26 percent in July. On the other hand, high-yield bonds (which are riskier but offer higher returns) ended the month with gains. The Bloomberg U.S. Corporate High Yield Index gained 0.45 percent for the month.

Trade Progress Helped Support Markets

Just like in recent months, progress on trade negotiations helped keep markets steady. In July, early outlines of trade deals with the European Union and Japan were announced. While we’re still waiting on the full details, these developments were seen as positive signs by investors.

Economic Data Remains Strong

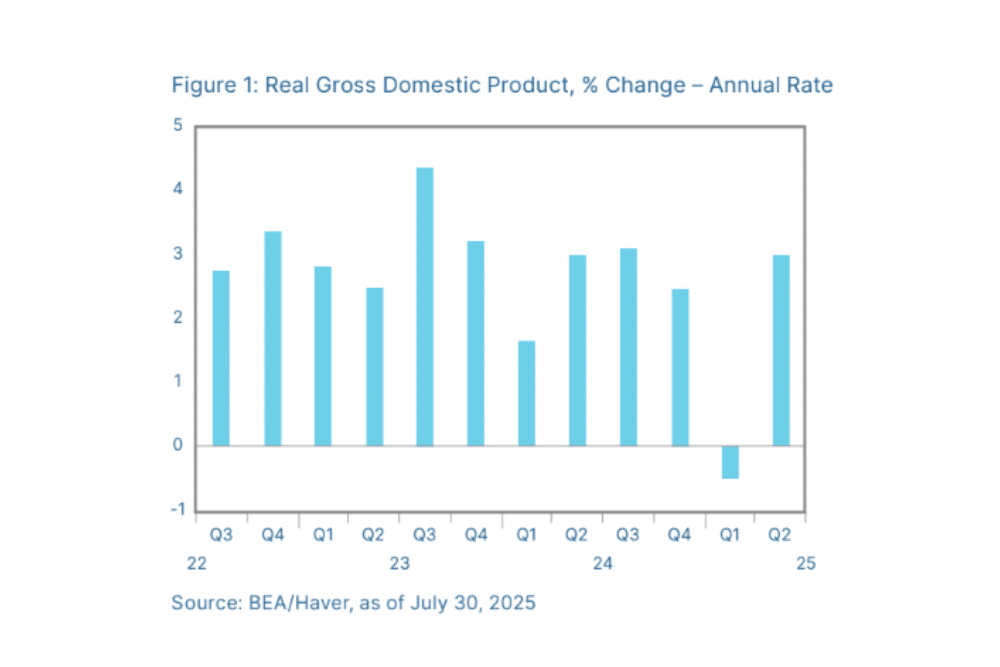

The economic reports released in July were also mostly positive. The first estimate of economic growth (GDP) for the second quarter showed the economy growing at a 3 percent annual rate—stronger than expected and a sign of a healthy economy. As seen in Figure 1, this result represents a return to growth following a modest contraction in the first quarter.

The job market also held up well. The June jobs report showed that companies kept hiring, even though the unemployment rate ticked up slightly during the month.

Risks Still on the Radar

Despite the strong earnings and solid economic data, there are still risks that investors should keep an eye on. Geopolitical conflicts remain a concern. While these issues have made headlines, they haven’t had a major impact on markets so far.

There’s also still a lot of uncertainty around government policy from Washington. Even though progress was made on trade in July, unexpected political developments could still create challenges for the market in the months ahead.

All in all, things are looking pretty good as we head into August. Company fundamentals are strong, and the economy is in good shape. While it’s important to stay aware of potential risks, the long-term outlook remains positive, with expectations for continued growth and rising markets. If concerns remain, you should speak with your financial advisor to go over your financial plans.

Ready to Get Started?

Let’s start the conversation about your financial goals. Fill out this quick form, and we’ll set up a time to talk.

What’s in it for you? A friendly financial expert who’s all ears (no sales pitches or fancy presentations, we promise!).